COLLECTING RISK PREMIA FOR VARIOUS ASSETS

We have identified ways in which it is profitable to collect risk premia for various assets (in particular volatility risk premium and liquidity risk premium) in a way that is not affected by the business cycles on conventional assets, e.g. equities or bonds.

STRATEGIES BASED ON DURABLE SOURCES OF PROFITS

This way, our strategies are based on durable sources of profits and not ephemeral or transient opportunities. The fund’s main idea is to invest on the frontiers of finance in a smart way, avoiding direct downside exposure. Since we aim to profit in all market conditions, we start with identification of global macroeconomic trends across all major world economies (this includes both developed and emerging markets) and construct a model investing in equity and debt derivatives.

CAPTURING VOLATILITY RISK PREMIUM

As the next stage, we move on to options and volatility derivatives, aiming at capturing volatility risk premium and using volatility arbitrage (which is analogous to providing a sort of insurance, for which considerable reward is received). The same logic applies to the wide spectrum of investments - rather than investing directly in benchmark long only strategies.

NEW ASSET CLASSES

Finally, there can be other assets division, which harvests the premium for taking the risks of newly set up projects in the latly dicovered branch of the economy. This is a unique value proposition for the investors in the hedge fund landscape and we are sure that given the current state of regulated markets it is the best moment to allocate at least part of investors’ wealth into this activity.

TYPE OF INVESTMENTS STRATEGIES

Main types of strategies:

► Short Volatility, directional and hedged,

► Global Macro/Fundamentals, Equity Hedged,

► Market Neutral, Long/Short and Pair Trading,

► Momentum, Contrarian, Relative Strength,

► Relative value arbitrage, Statistical Arbitrage, Fixed-Income Arbitrage,

► Complex Long/Short Option Strategies,

► Event Driven, Merger Arbitrage, Distressed Restructuring,

► Pattern analysis

TYPE OF BASIS INSTRUMENTS

► Algorithmics strategies are based mainly on options and futures market

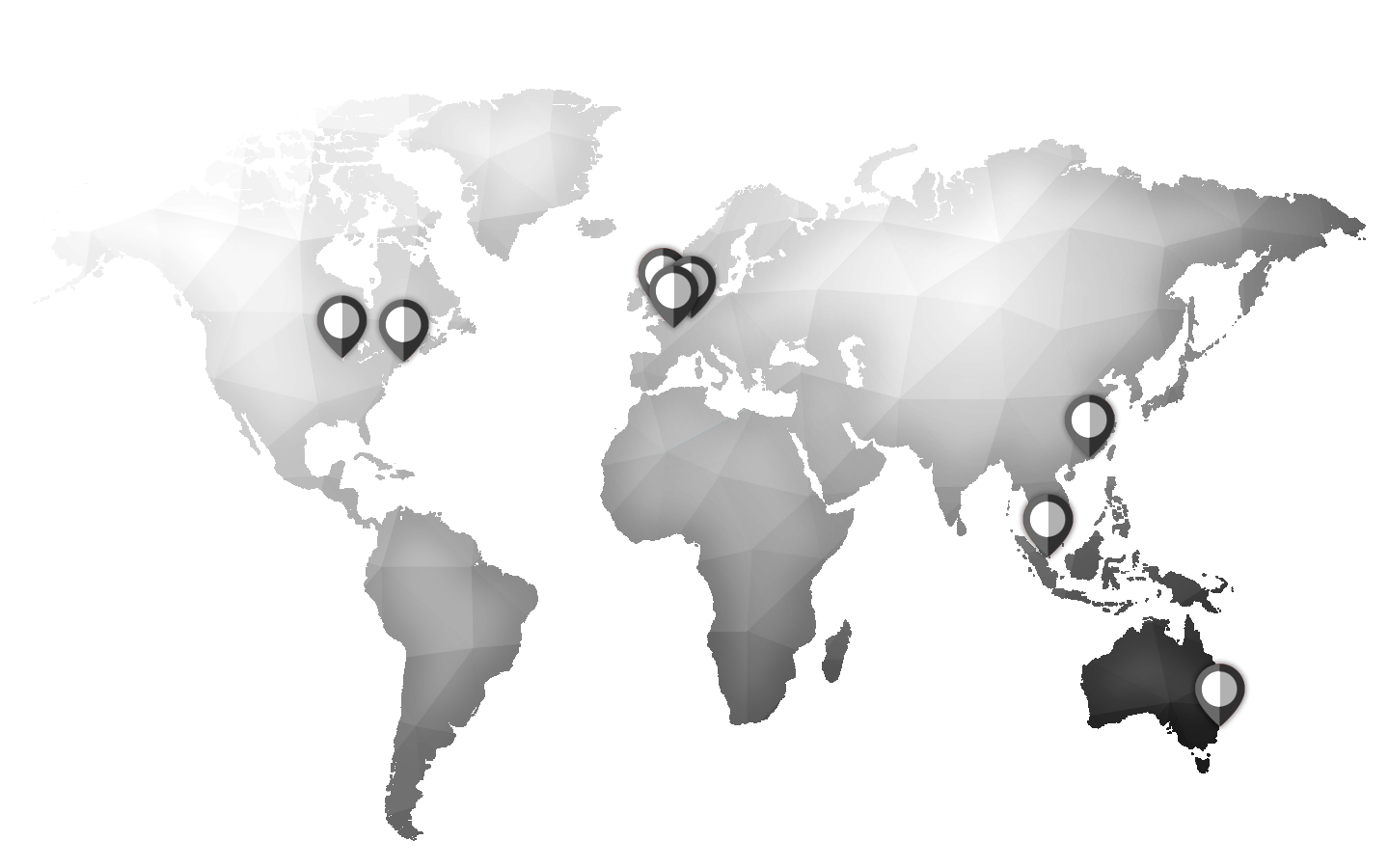

► Investment model will work on the following exchanges: CBOE, CFE, CBOT, AMEX, EUREX, OSAKA, Euronext, etc., located on almost each continent

► Main markets in geographical sense: North America, Europe, Asia

► Our derivatives strategies are based on basis instruments from almost each asset class: stocks, equity indices, bonds, volatility, commodity, etc.